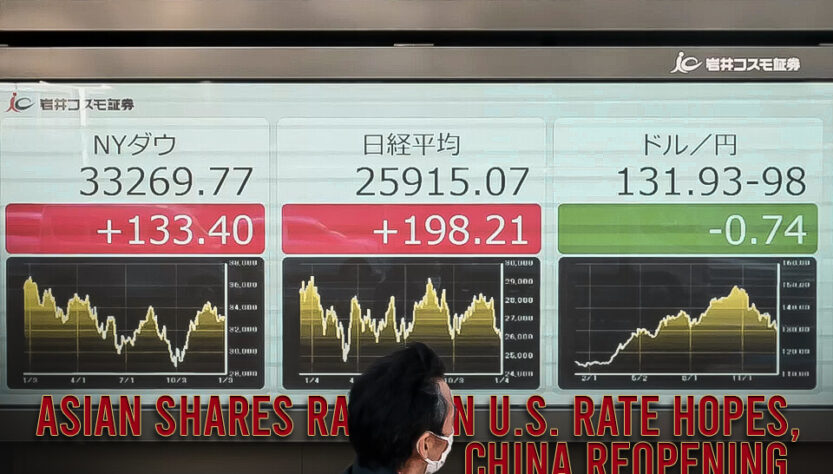

As China’s reopening and a falling dollar enticed investors back to the area, Asia’s leading stock index was on track to launch a bull market.

The MSCI Asia Pacific Index increased by up to 1.6% on Monday, bringing its gain from a low point of October 24 to more than 20%. While Japan was closed for vacation, Hong Kong and South Korea gauges led session gains.

The probable achievement represents a turning point for the MSCI Asia index, which fell roughly 40% from its peak in early 2021 as China adhered to its strict Covid-zero policy and the region’s top chip stocks saw a downturn due to declining demand. However, since November, Chinese stocks, which after Japan have the second-highest weighting in the Asia gauge, have improved as the country has indicated a move away from virus-control measures.

The S&P 500 Index is up around two percentage points compared to the Asian benchmark, which is up 3.6% in 2023. However, they declined nearly 19% last year, their worst performance since 2008.

Charu Chanana, the senior analyst at Saxo Capital Markets Pte, stated that since the surge has been so quick and intense, some profit-taking is expected. “There are other hazards to be aware of, such as the BOJ’s shift to a more hawkish stance and firm profits. Despite this, there is still space for Asian markets to perform better than their international counterparts in 2023.

China’s stocks have had a great start to 2023 after spending much of last year in a negative spiral because of worries about the financial impact of viral restrictions. The market has received extra support from reduced regulatory concerns and additional initiatives to revitalize the struggling real estate industry, contributing to Asia’s rise.

As of 10:27 a.m. local time, a gauge of Chinese stocks listed in Hong Kong increased 1.8%, bringing its gain for the year to more than 8%. Alibaba Group Holding Ltd. was the market leader in the tech sector as traders may have become more convinced due to comments made by Guo Shuqing, party secretary of the People’s Bank of China, that restrictions on the industry are ending.

Investors are preparing for additional gains in China, with equities tied to consumers anticipated to lead the advance. In addition, amid signs that the Federal Reserve will likely moderate the pace of interest rate rises, tech companies in Asia have also rallied.

Banny Lam, managing director of CEB International Investment Corp., stated that when the US currency declines, liquidity will return to the markets in the Asia-Pacific region. I think the rally is more long-lasting because there is potential for growth because of the regional economy’s strengthening outlook and the decline in 2022.

- Published By Team Genuine Reporter